We are undoubtedly living in the era of creator economy. Anyone can become a public figure, as long as they have access to an internet-connected device. Long gone the days of CNBC or BBC being the only trustworthy news source, or TV commercials being the only path towards exposure and fame.

However, most of the value produced by these ingenious independent creators of our time is gatekept by internet platforms, especially the “Big Tech”. Thus, they remain under the mercy of the “walled garden” that they are locked into. Although platforms ought to get their rightful share of the accrued value, the creators of today are still unfairly shortchanged.

But what if we can harness the power of the blockchain to provide them with a fair slice of the value pie? What would happen if creators are given the liberty to explore various types of engagement and value creation methods without being ‘chained’ by the terms and conditions of rent-seeking third-parties?

Enter social tokens.

Social Tokens: Giving Power Back to Creators

“His recent hat-trick in the final of an intercollegiate football tournament has just sent his stock soaring.”

Prior to social tokens, this lucky guy would probably ‘only’ get lots of clout — with the introduction of social tokens however, his excellent performance would literally send his tokens soaring!

In a nutshell, social tokens are tokens imbued with certain rights or utilities by its issuer. In the case of our college footballer, he may decide that his social tokens will entitle holders to a 20% share of his footballing income until the age of 25, plus a scheduled dinner with him for large holders capped at once a year.

You can see where this goes. Social tokens (and with it, ‘SocialFi’) provide creators with a slew of options to engage fans or monetize their brand. Imagine if creatives such as musicians, artists, and athletes can be given the same “entrepreneurial footing” with business owners. Creators who feel that the current status quo might have restricted their entrepreneurial output are now “set free” again. Sooner or later, you might even see creatives breaking the Bloomberg Billionaires Index!

With the context being set, we will now go through some scenarios on how social tokens might play out in the real world. While this is by no means an exhaustive list (we might have missed some key points as well!), in most cases social tokens would fall into either one of these three use cases: 1) income sharing agreements; 2) exclusive real-world utility; 3) loyalty programs.

Use Case #1: Income Sharing Agreements (ISA)

This might be the most obvious use case for social tokens if you look at it purely from an investment lens. TradFi (or “traditional finance”) professionals would also find this much easier to understand, as the token itself represents a claim to future “cash flows”, making it quite straightforward to assign a valuation to it.

Creators can specify the terms of the income sharing agreement prior to launching their token. This can take on any form; a few examples:

- A musician entitling holders to 30% of his music royalties till he turns 30;

- A virtual asset creator entitling holders to a lifetime 10% claim on all of his current and future NFTs sold on the secondary market.

This is basically TradFi stuff, but just done more efficiently with social tokens.

Use Case #2: Exclusive Real-World Utility

On the contrary to income sharing agreements, social tokens that belong solely on this spectrum will be extremely difficult to be assigned a tangible value. This is because the “value” of the token itself is the various real-world interactions and experiences that the creator has promised to fulfill for token holders. To illustrate the point, how do you put a dollar value on a dinner outing with Cristiano Ronaldo, or a tennis session with Roger Federer?

One thing that is certain: although it is hard to assign a tangible value to the token, interactions and experiences with your favorite creators undeniably brings value to its fans. To put things into perspective, here are some examples of real-world utility that creators might imbue to their tokens:

- A celebrity treating token holders to exclusive meet-and-greet sessions;

- A singer allocating a select number of VIP seats for token holders, no matter the region where the concert is held;

- A public figure hosting a one-off lavish party in his private mansion, only allowing access to holders who have held the token for at least two years;

- A chance to enjoy a private basketball session with a world-renowned basketball player for holders holding at least a certain number of tokens;

- A celebrity giving exclusive merchandise for fans who have accumulated enough social tokens to redeem it;

- A basketball club letting token holders to vote on what song to play on its stadium on player entrance, defense, offense, time-outs, half-time, and etc.

Value doesn’t have to be in form of financial upside. Income sharing agreements are great, but there is no reason why social tokens purely offering exclusive real-world utility can’t be valued on the same level of good-faith. Dismissing them is just plain ignorant — heck sometimes they could be worth more!

Use Case #3: Loyalty Programs

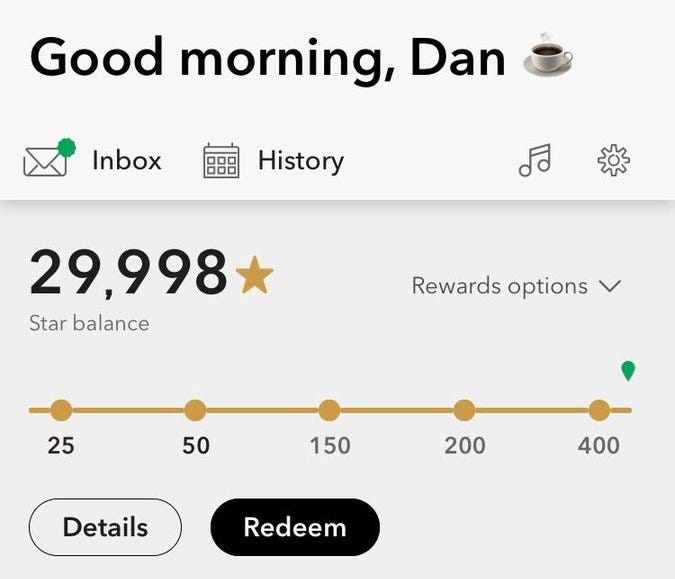

Remember your unused Starbucks loyalty rewards due to your relocation? How about your frequent flyer miles from a local airline that you have been dying to redeem for a trip to Tokyo, but hasn’t been able to as you have reservations on travelling in the midst of COVID-19? What if you’re told that you can convert these “leftover” perks to real money?

Make no mistake, the above proposition would be feasible if loyalty programs are put on the blockchain in form of social tokens (or in this case, brand tokens). Holders would be able to swap it with other cryptocurrencies of their choice, and its value would be based on the perceived benefit that a holder can get out of each unit of token.

In the case of your Starbucks loyalty rewards, if it is represented in form of social tokens (the ‘creator’ in this case would be Starbucks itself), then its value would be based on how many cups of coffee that it could be exchanged to, discounted slightly due to illiquidity (as the token is only exchangeable for Starbucks coffee).

Like current loyalty programs, here are some examples to earn social tokens:

- A football club running a score prediction contest, where each correct score prediction entitles fans to a number of social tokens;

- A celebrity giving out a select number of social tokens to all fans that will attend his upcoming concert in London;

- A musician rewarding its fans with social tokens every week if their cumulative streaming time of his songs reaches 24 hours.

When paired with “exclusive real-world utility”, the issuer of the social tokens has effectively designed a micro-economy revolving around themselves. The loyalty programs will form the “earning” part of the economy, while the real-world utility will form the “spending” part of it.

SocialFi: The Great Equalizer

Social tokens allow creatives, irrespective of the field that they’re in, to design their own micro-economies — a luxury that is previously only available for established businesses to tap into. In the presence of social tokens, PayPal’s and Venmo’s tip jars would quickly become a relic of the past in the eyes of future creatives.

The golden age of entrepreneurial creatives is just around the corner — SocialFi, is here to stay.