“Corporate greed is evil!”, “DAOs will change everything!”, “Unlike corporate governance, anyone can have a say in DAOs!”. These are some widespread stigmas that, for a good reason, is widespread.

For a fact, DAOs are indeed, a revolutionary governance structure. It allows people, no matter where they are in the world, to have a say in the day-to-day operations of the DAO-governed protocol.

Before the advent of the blockchain, there is simply no way at all for people from all corners of the world to be as participative as right now in governing an entity. Given the same number of DAO tokens, a person in Africa right now can have equal influence with a person in say, downtown Manhattan, towards pending issues on the protocol.

However, DAOs are not the all-conquering innovation that most people make it out to be; most people misunderstand (understandably) what exactly is a DAO.

The Cold-Hard Reality of DAOs

Dialing down the hype, a DAO (or a decentralized autonomous organization) is simply a vehicle in which a democratized decision-making process towards proposals can take place. Sadly, most DAOs are anything but autonomous.

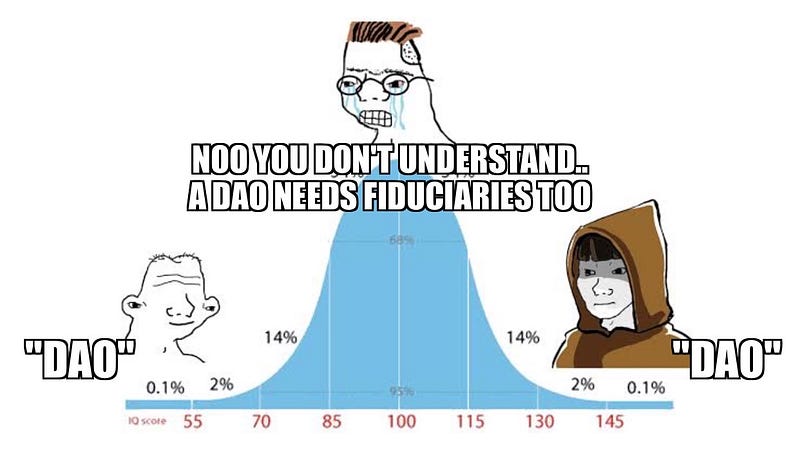

Just like any other governance structure, a DAO will need fiduciaries (or agents) to “run” it, as well as principals to govern it. In layman’s terms, you have the sitting “management” to manage the entity, and the “token-holders” to oversee it. Even for the most established protocols like Uniswap or Aave, they still employ fiduciaries to maintain their codebase, hosting, and other ad-hoc matters.

While it is a marked improvement if compared with corporate governance, the fiduciaries of a DAO are also… wait for it… humans!

Surprisingly to most it seems, fiduciaries are not robots that will carry out a majority DAO consensus without deliberation. In practice, there hasn’t been a case where developers blatantly refused to do what the majority of the DAO has decided with — but in the future at some point, there will inevitably be issues where the incentives of a project’s principals (the DAO token-holders) will contradict the incentives of its fiduciaries.

Let’s take PancakeSwap as an example. At the time of this writing, it is by far the largest DEX in BNB Chain by volume. For illustrative purposes only, imagine if one day BNB Chain for whatever reason suddenly implodes (Terra-style), which means PancakeSwap as a project must decide on which EVM-compatible blockchain do they want to migrate PancakeSwap to.

The DAO, mostly made up of retail users, votes for Fantom, as it is the fastest EVM-compatible chain. On the other hand, PancakeSwap’s core developers (the fiduciaries) value security and decentralization over speed. They posit that it will be much better if PancakeSwap migrates to Ethereum, and in a bold move against the DAO’s majority consensus vote, PancakeSwap is migrated to Ethereum.

Based on the above scenario, in the event that rogue developers fail to follow through on its fiduciary duties, the DAO token-holders have only two recourse: follow the migration to Ethereum, or forking PancakeSwap on Fantom, plus appointing new fiduciaries to manage day-to-day operations — surely not the ideal DAO governance paradise that everyone is expecting, eh?

The point is, DAOs are not a cure-all solution that will unequivocally grant whatever the people wish for. In the end, the core team of a protocol will be acting as fiduciaries whether you like it or not, which means you will have to trust them to act in good-faith and prioritize the DAO’s majority consensus at all times over their own resolve.

In addition, recall from our previous illustration that the only two recourse DAO token-holders can have in event of rogue fiduciaries is to either follow them, or to fork the protocol. This leads us to the most important criteria, one that makes a DAO work in the first place: an open-source codebase.

Absent this requirement, a DAO is as good as useless — not having the ability to fork simply means that nobody besides the protocol’s fiduciaries has any real voice whatsoever regarding the direction of the project.

Decentralization and Centralization: A Mutually Exclusive Relationship?

Building on from the above, governance of an entity is not a black-or-white choice between decentralization and centralization. Again, surprisingly to most it seems, they can actually… wait for it… coexist!

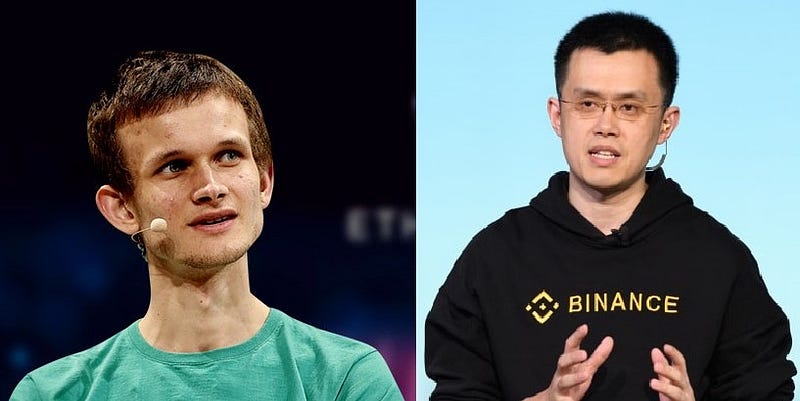

In any case, decentralization does not replace centralization — it merely complements it. Ethereum is Ethereum because of the vision of its core team. Same goes with Solana, Avalanche, or any other prominent cryptocurrencies out there.

While technically anyone can fork any of these cryptocurrencies and then spin up a new foundation to oversee it, gathering support is another thing altogether. Ask yourself, would your level of support for Ethereum remain the same if Vitalik Buterin is not involved anymore?

The takeaway is, a healthy level of centralization gives a project its identity. The DAO merely exists as a mechanism to keep centralized incentives in check — allowing for a democratized decision-making process with regards to a project’s strategic direction, not to outright govern it.

Repeated for emphasis, the ones that will ultimately be pulling the shots will not be the DAO itself, but the protocol’s core team (or foundation). By law of nature, if the core team abuses its power (or is simply in disagreement with its DAO token-holders: aka the public), a project can be forked given enough support. For instance, the Bitcoin Cash fork on Bitcoin due to disagreement in block size, or the Ethereum Classic fork on Ethereum due to opposing views on resolution handling in the aftermath of TheDAO hack.

This is why open sourcing code for DAO-governed projects are so important, as it indicates to the public that you can be trusted to not abuse your authority (or at least is willing to be the subject of disagreement), and will actively engage them with regards to the project’s development and roadmap.

A Cause for Optimism

If there is one thing that we can take away since Bitcoin was first invented, it is that humans as a species are inherently good beings. Ethereum is fully open-source, as well as all the other major blockchains. People can fork their own version of Ethereum at any moment if they want to, but despite the numerous ill-intentioned forks of Ethereum, the only one that is still omnipresent until now is the “OG” Ethereum. Same goes to Bitcoin, Solana, and practically all other open-source blockchain networks.

Wikipedia allows anyone, regardless of background and qualification, to create new entries or edit existing ones. When it first launched back in 2001, you can’t help but expect that there will be lots of low quality entries and vandalism due to the absence of a supervising authority. Fast forward to the present, Wikipedia has arguably become one of the most reliable sources of information on the internet. Talk about irony!

As such, you can bet that despite the lack of “binding agreements” between the fiduciaries and principals of a DAO-governed project, the inclusiveness and participation that it brings to the table far exceeds anything of that sort that the conventional top-down corporate governance model is able to offer.

Simply put, DAOs are here to stay.